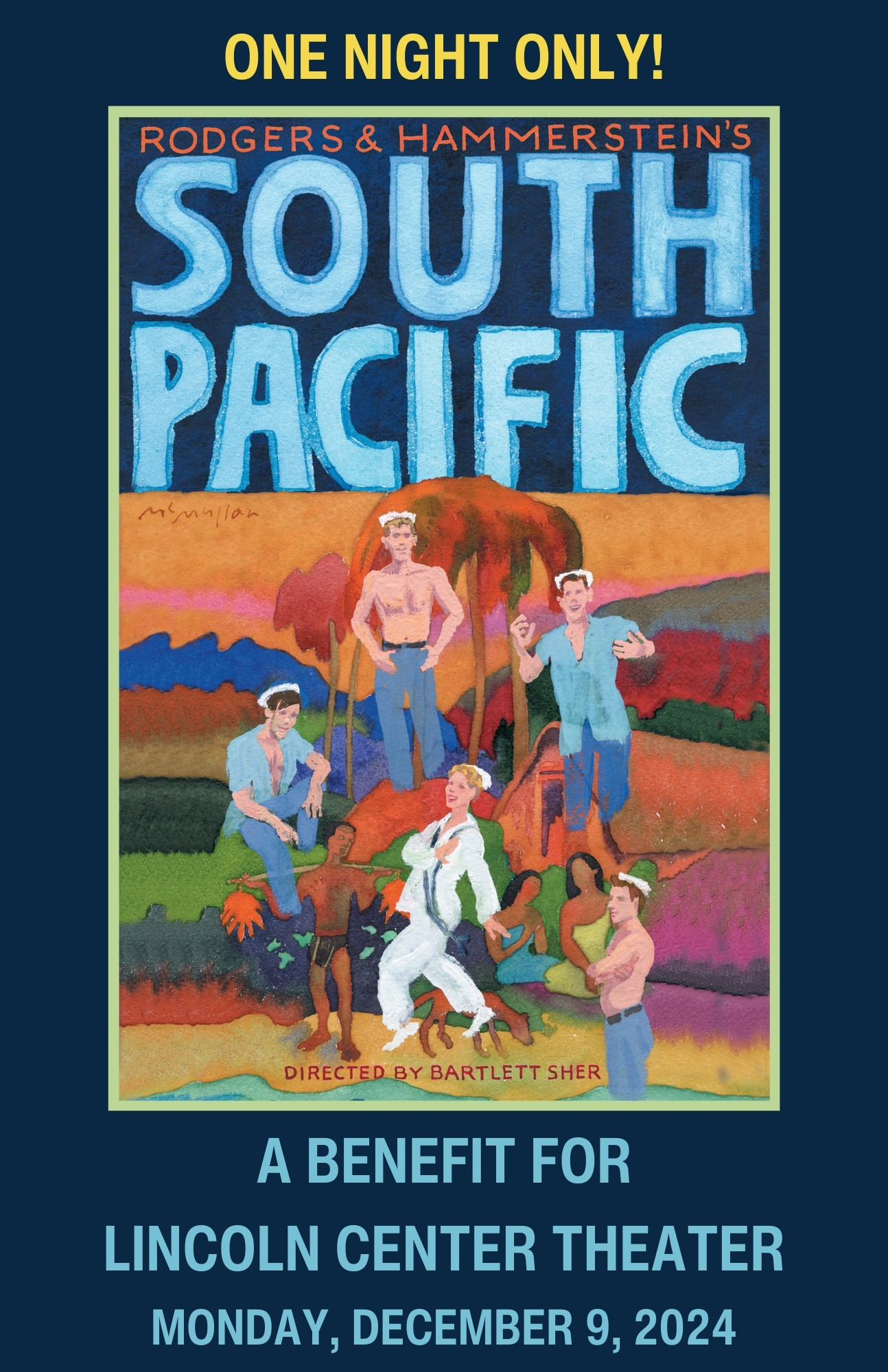

Thank you to everyone who helped make our SOUTH PACIFIC Benefit a success!

To make a post-event contribution, please make your donation here, or contact Angélica Vicens, Associate of Special Events at vicens@lct.org / 212.501.329

FOR CHECK PAYMENT:

Make check payable to "Lincoln Center Theater" and mail to:

Karin Schall, Associate Director of Development & Special Events Manager

Lincoln Center Theater

150 West 65th Street

New York, NY 10023

FOR STOCK, CASH WIRE OR ACH TRANSFER PAYMENT*:

Plese contact Angélica Vicens, Associate of Special Events, at 212.501.3292 or vicens@lct.org for wiring and transfer instructions.

Donor Advised Funds:

Please note that the IRS prohibits the use of Donor Advised Funds where more than an incidental benefit is received by the donor in return (e.g. event table/tickets). This prohibition applies regardless of whether the donor pays separately for the benefits received (i.e. the “non-deductible” amount). All table/ticket purchases, therefore, must be funded personally outside of a Donor Advised Fund. For further guidance, please consult with your Donor Advised Fund administrator.